This case study comes from the capital markets. Perforated Backpropogation TM was applied to stock trend forecasting on the China Securities Index (CSI) 300 dataset, one of the most challenging benchmarks in financial machine learning.

The Challenge

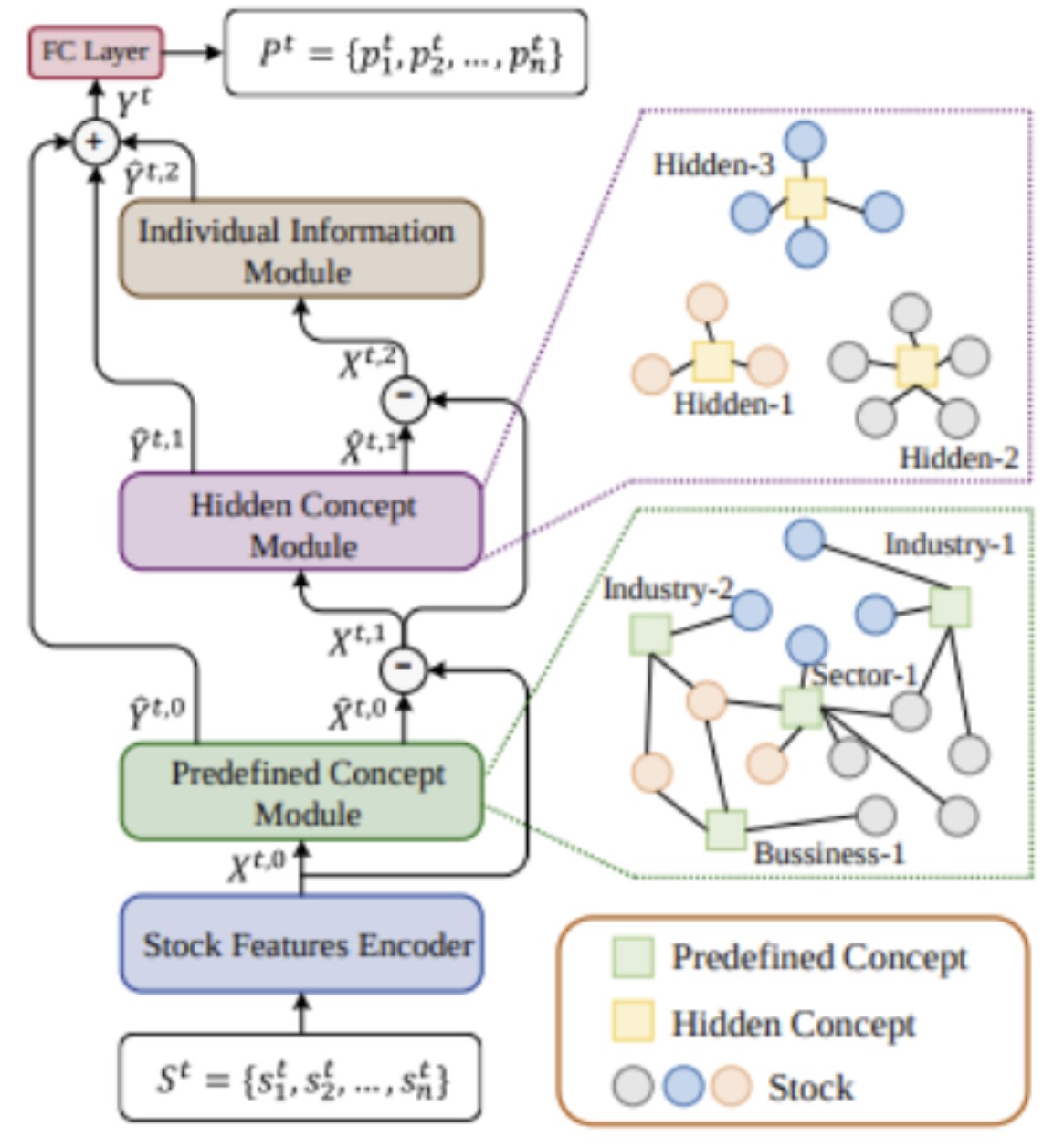

The CSI 300 dataset tracks the top 300 stocks in the Chinese capital markets, using features including opening price, closing price, highest price, lowest price, volume weighted average price, and trading volume. Each prediction leverages 60 days of historical data, constructing a 360-dimensional feature space. The work applied Perforated Backpropogration TM alongside HIST. HIST is a 2022 graph-based framework from Microsoft Research that mines concept-oriented shared information between stocks that held the highest annualized return in Microsoft's qlib model library—a highly competitive position for this dataset.

The Results

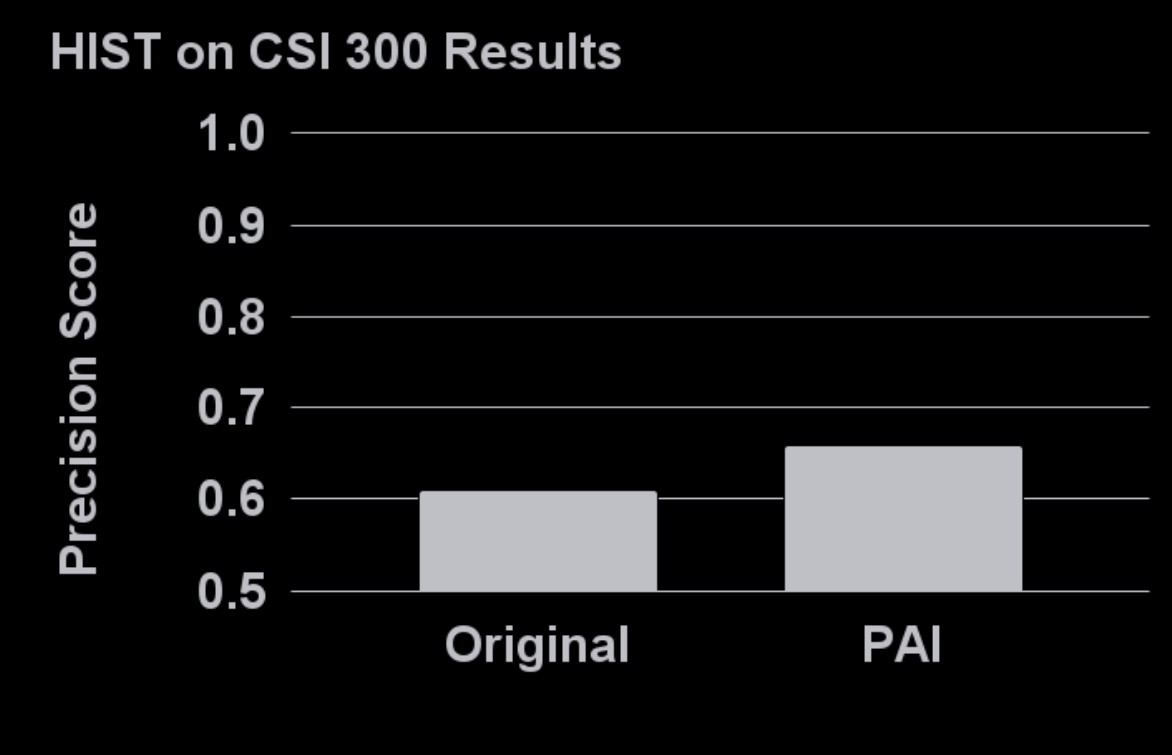

Integration of Perforated BackpropagationTM with the HIST architecture produced significant improvements. For example, results showed a 35% improvement in precision score over the 50-50 baseline. Across 10 deployments, the approach achieved an average improvement of 8.6%, demonstrating consistent and robust performance gains.

Real-World Impact

These improvements have direct implications for quantitative trading and portfolio management. Higher precision in stock trend forecasting means better risk-adjusted returns and more confident trading decisions. The results demonstrate that Perforated BackpropagationTM can effectively enhance financial prediction models in the world's most complex capital markets.

Ready to Optimize Your Models?

See how Perforated BackpropagationTM can improve your neural networks

Get Started Today